Standing in front of Van Gogh’s Starry Night and escaping into the dreamscape on the fifth floor of MoMA, New York, one can’t help but wish to own the artwork. With the growth in the token economy, it’s possible to own such fine art and other tangible assets that exist in the physical world through asset tokenization. Backed by traditional assets, RWAs are now serving as sustainable and reliable digital asset classes.

Over the last few years, tokenization has brought forth an increasing interest in bringing real-world assets (RWAs) on-chain. In this article, we understand the tokenization of real-world assets and their future.

What does it mean to tokenize RWAs?

Real-world assets or RWAs are fungible or non-fungible tokens representing traditional financial assets, such as real estate, art, gold, property rights, and commodities, on the blockchain. These transferable units enable people to invest in assets that were previously inaccessible.

The tokenization of RWAs, thereby, means to render the rights or ownership to an asset as a tradable, on-chain token on a blockchain where one can trade with a single fraction of the asset.

Why do we need to tokenize real-world assets?

Tokenizing real-world assets helps in creating a virtual investment vehicle on the blockchain for tangible items that can be traded among investors allowing a more extensive and diverse pool of buyers. This is a major breakthrough in its global adoption of blockchain, fostering financial inclusion and democratizing investment by lowering the barriers to entry. In broadening access to investments, we’re not just letting go of complex paperwork, intermediaries, and time-consuming processes, but also enhancing how we interact with economic systems by improving trust in the financial market.

Here are some more reasons for the need for asset tokenization:

- Tokenization of real-world assets helps promote the democratization of investment while eliminating mediators.

- It introduces crowdfunding and better liquidity in the market.

- Asset tokenization can increase transparency related to transactional data and asset characteristics among the issuers.

- Tokenization automates various aspects of transferring ownership of an asset, which can save time and associated costs.

How does RWA tokenization work?

Now, we know the goal of asset tokenization is to convert physical assets into blockchain-based digital tokens by using distributed ledger technology (DLT).

RWA tokenization involves the conversion of every aspect of the real asset to a tradable digital token on blockchain that can be issued to investors and buyers. By following a set of tokenization rules, asset tokenization companies maintain ownership records of digital tokens on a decentralized ledger, thereby providing a digital investment vehicle.

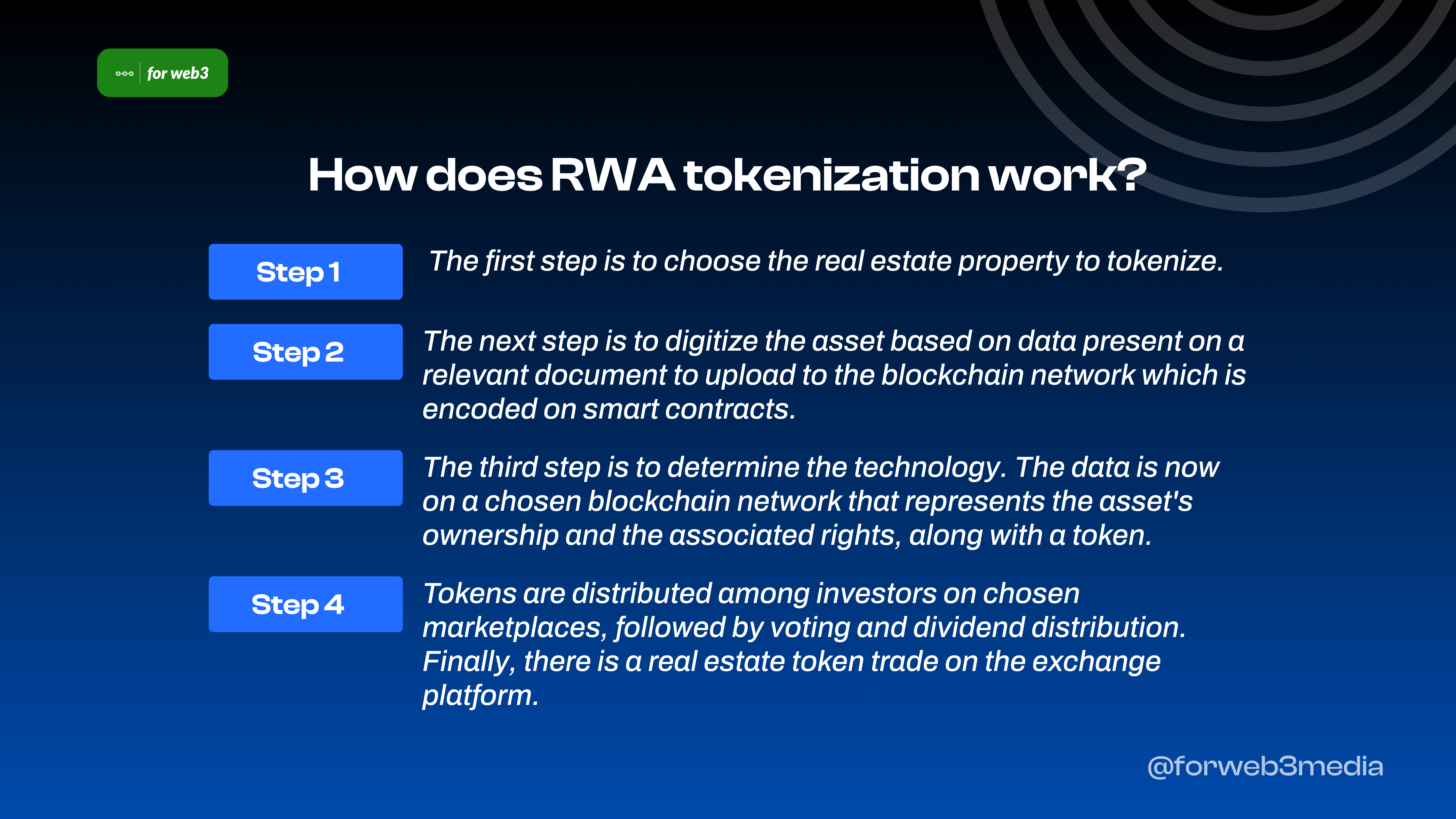

Taking the example of real estate tokenization, here’s how it works:

Step 1: The first step is to choose the real estate property to tokenize. Asset owners can determine the type of property to invest in, such as a residential property, commercial building, or any other type of real estate asset. This also involves determining the shareholder type, terms & conditions, legal formations, and return on investment.

Step 2: The next step is to digitize the asset based on data present on a relevant document to upload to the blockchain network which is encoded on smart contracts. There is a provision of security tokens as well.

Step 3: The third step is to determine the technology. The data is now on a chosen blockchain network that represents the asset’s ownership and the associated rights, along with a token. KYC verification is required here to ensure compliance with Anti-Money Laundering (AML) laws and regulations & ensure that token issuers are not transacting with funds that come from illicit activities.

Step 4: To conduct a private or public offering of the tokens, there is a need for a marketplace, compliance with securities regulations, and payment methods. Tokens are distributed among investors on chosen marketplaces, followed by voting and dividend distribution. Finally, there is a real estate token trade on the exchange platform.

Factors to Consider While Tokenizing RWA

Below are some factors to consider white tokenizing real-world assets:

- Transparency: Transparency helps in building trust among participants, like investors, token issuers, and regulatory bodies. It’s also a key factor in demonstrating compliance, mitigating risk, improving price discovery, and boosting investor accountability.

- Custody and security: Custody and security measures help in asset protection and enable data privacy, especially with sensitive data such as electronic health records (EHRs) or intellectual property. Secure custody establishes clear ownership and control over the digital tokens while preventing fraud.

- Business model: Choosing the right business model defines sources of income, such as transaction fees or token issuance fees. It can attract the right investors by providing clarity about the financial benefits, value proposition, and profit distribution.

- Liquidity: Liquidity is an important factor for token holders which includes how tokens are traded and sold in secondary markets, contributing to overall market liquidity. It also helps them diversify their portfolios and enhance the attractiveness of the tokenized asset.

Use-cases of RWA Tokenization

RWA tokenization has a wide range of use cases across various industries. Here are some use cases:

Art and collectibles

The tokenization of art and collectibles makes it possible for art enthusiasts and investors to own fractions of valuable artworks, much like purchasing fractions of a publicly traded company. This helps everyone to have access to the art market and enables trading and investment in fine art. BetaBlocks provides a platform for creating digital assets and NFTs. It supports multiple blockchain networks, including Ethereum, Polygon, and Stellar, and uses predefined templates for storefronts.

Commodities

Tokenizing commodities like precious metals, agricultural products, and energy resources reduces the overhead for paperless transactions and enables investors to gain exposure to physical commodities without the need for transportation or storage of the actual assets. For instance, tZero, a FinTech company, has designated an alternative trading system (ATS) and provides market-based solutions for investors, entrepreneurs, and companies. Its mission is to democratize access to capital markets by establishing more efficient, accessible, and transparent marketplaces.

Intellectual property

Investors can have rights to intellectual property, such as trademarks, trade secrets, patents, and copyrights, to distribute ownership and monetization rights to a larger pool of investors. This helps with increased liquidity & transparency. Creative Mint works towards building a platform to democratize and decentralize creative IP rights using blockchain technology.

Music and royalties

The music industry is a complex one with expensive legal processes. Asset tokenization can help solve the problem by reducing transaction costs. Non-fungible tokens (NFTs) enable the tokenization of music and help artists interact with their fans & increase their fanbase by tokenizing backstage footage or recordings of live performances. Both fans and institutional investors can purchase tokens, such as an artist’s music portfolio, and get regular dividends in the form of royalty payments. Collaborators can automatically split their share with a sale with the use of smart contracts while reducing intermediaries.

OnChain Music is a blockchain music distributor and sync licensing platform that helps musicians earn more money from their royalties through the sale of NFTs.

Healthcare

Tokenization in healthcare opens up new avenues beyond institutional investors where anyone can purchase tokens, say, a particular drug, and reap the benefits as dividends in the future. It helps bridge the funding gap in the healthcare sector, by increasing the global investor base, while improving patient care and protecting highly vulnerable patient data. Interested investors can tokenize equipment assets too, such as MRI scanners, X-ray machines, or surgical robots.

BlockPharma is a France-based blockchain technology firm that works towards drug traceability and anti-counterfeiting, while LexisNexis Risk Solutions offers patient-centric tokenization to access healthcare datasets.

Future of RWA Tokenization

Picture a world where you can own a part of your favorite artwork just like holding equity in a promising startup with just a few taps on your smartphone.

The tokenization of RWAs revolutionizes the way we invest, trade, and access valuable assets. Through the ingenious fusion of traditional assets with blockchain technology, new-age investors can now have access to tokenized assets to diversify their portfolios.

It’s no longer a vision of the distant future; it’s the present with continued expansion into new asset classes with the integration of DeFi and the secondary market. And what’s more, as the asset tokenization market matures, we’ll see more coherence and consolidation with the emergence of strong projects and platforms.